The coronavirus (COVID-19) outbreak has caused a global natural emergency, impacting the global economy. Every sector in the economy has been affected including trade, investment, IT, Tourism,

finance, etc.

Small businesses are major pillars of the UK economy. Business owners reported decreased turnover (66%), customer demand (58%), workforce (56%), and cash flow (60%) as the most important negative consequences of the pandemic.

There are more than 5 million small and medium-sized enterprises (SMEs) in the UK that have been severely impacted despite several government measures. According to the Business Emergency Resilience Group (BERG), small and medium businesses employ 16.1 million people in the UK, which is 60 percent of the UK population.

How are SMEs doing in COVID19?

Based on the research conducted by Aldermore, SMEs in the UK have lost 30% of their monthly business revenue during the pandemic. Both supply and demand side firms have been affected. Companies operated with a reduced workforce, shortages of raw material and intermediate goods.

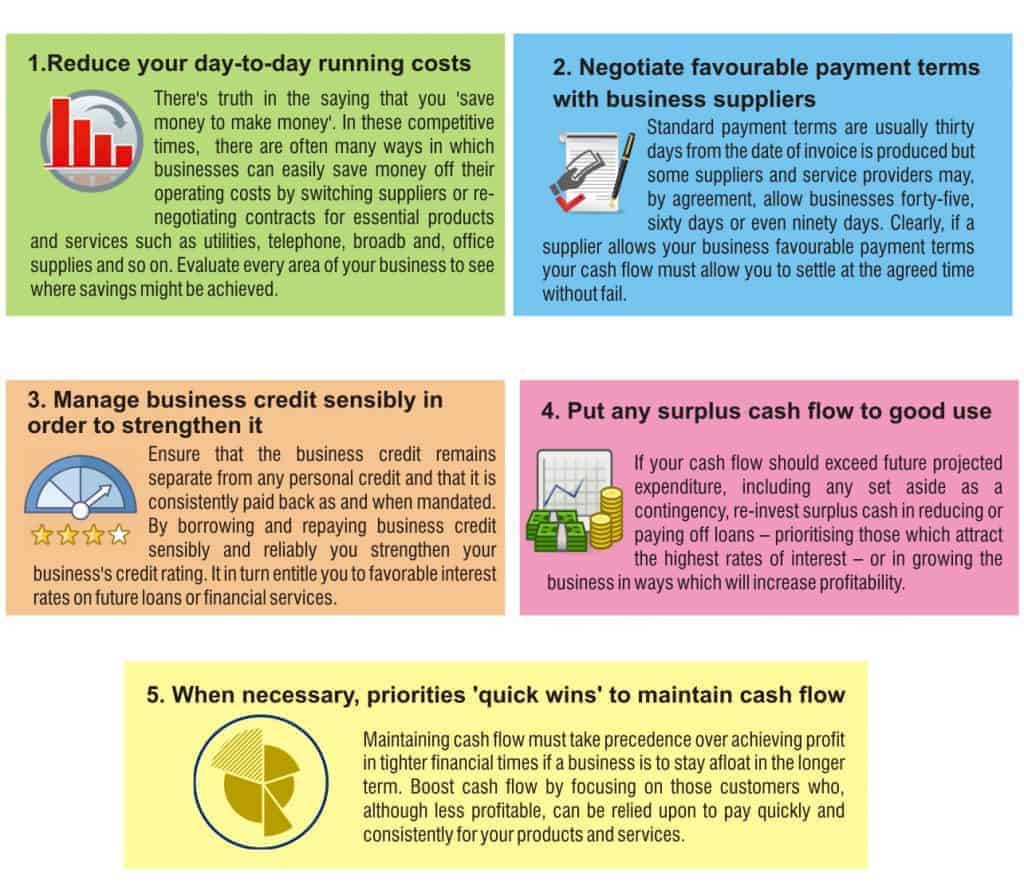

The reduced spending resulted in a dramatic fall in market demand. As per the Aldermore research, two in five SMEs in UK, (i.e. 51%) adjusted their business strategy with cost-saving initiatives in the very first phase of lockdown.

SME Resilience strategies helping the economy bounce back

To everyone’s surprise, with each passing month, SMEs appeared to have recovered more strongly than expected. Companies demonstrated significant resilience strategies with different modern solutions to cope with changing horizons. The study by Hitachi Capital Invoice Finance states 79 percent of business owners shifted to the work from home (WFH) model.

Businesses are striving consistently to keep employee engagement rate high even using the work from home system. Several communication channels such as Skype, Zoom, Google meet, and Microsoft Teams are widely used by large, medium and small firms.

According to the Economic Recovery Survey, one-third of SMEs operating in work from home modules are planning to continue remote working even after the pandemic. On an average, revenue for SMEs crashed 6.6% during the last six months. Cost-cutting measures like work from home will reduce unnecessary expenditure in infrastructure rent, maintenance, food and electricity bills.

This new working pattern has brought great flexibility in working for employees and the company as well. The available digital technology is capable of providing a responsive work environment for employees. Small firms are proving to be more agile and adaptive to the changing circumstances by investing in technology to retain productivity and high standards, even with a smaller workforce.

Corient’s support for SMEs

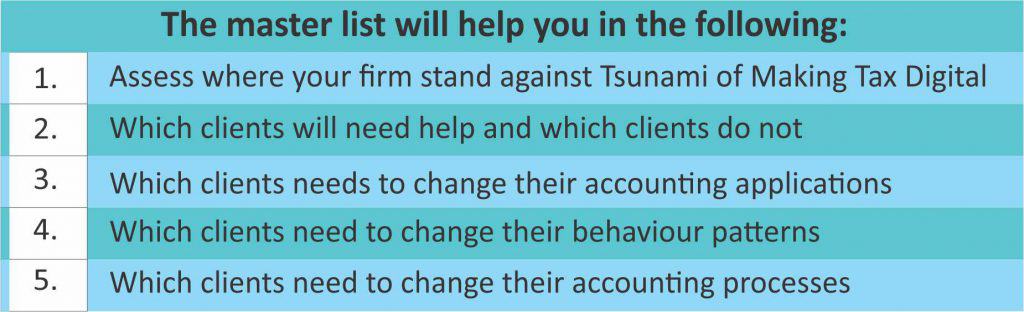

Corient launched an initiative for small businesses impacted by Covid-19, offering a reliable technology for an end-to-end solution for its accounting clients. It is outsourcing the accounting and bookkeeping services for finance and accounting companies to continue delivering even in these tough times.

We reduce manual work by replacing it with accurate and quick automation alternatives for Accountants and Accounting companies. This digital transformation will enable firms to recover revenues by supplying services without human intervention and without enhanced salary costs. This will provide a responsive solution with faster results to its clients.

Even though severely impacted by coronavirus, many positive steps are being taken by businesses to become more resilient. SME business owners have regained confidence in the economy.

They have a positive outlook and intend to survive the pandemic and grow during the next few months.

How we see the future

Regardless of the current challenges, most SMEs are using every opportunity to deliver services to their clients using smart and efficient technology. UK SMEs have exhibited strong resilience during the pandemic, building strong ties to help each other move forward together.

As always, there will be new challenges to face but SMEs in the UK should be able to sail through with a comprehensive and focused business strategy and quick adaptability. For more features offered by Corient, stay tuned……